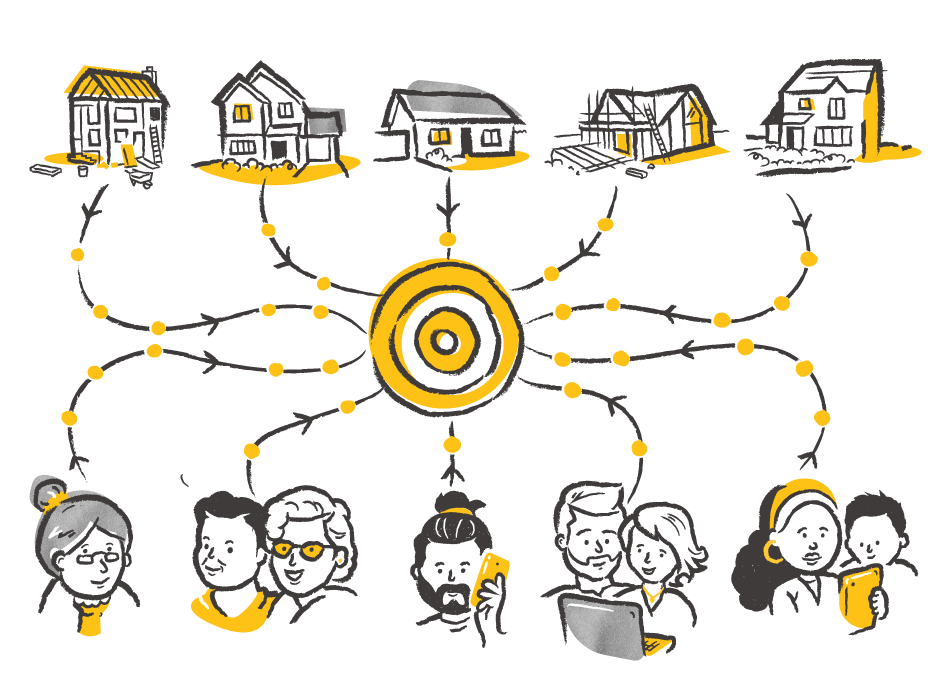

Hassle-free new build mortgages.

We join the dots between your new build development and your list of interested buyers. We do this by finding the best new build mortgages to meet your purchasers’ needs. Our dedicated team are on hand 7 days a week to offer your purchasers fee-free mortgage advice. We’re completely impartial and only recommend the most suitable mortgages.

FAQs

Green mortgages can offer more competitive mortgage rates as some lenders discount the rates as a reward for those purchasing energy efficient properties. Each lender will have its own terms and conditions and maximum loan to values for green mortgages. Purchasers will likely need an EPC (Energy Performance Certificate) or PEA (Predicted Energy Assessment) at A or B to qualify.

In Wales, the extension of the Help to Buy equity scheme for first time buyers until March 2025, along with an increased price cap of £300,000 is great news.

In England whilst there is no Help to Buy equity scheme there are options available to help purchasers such as the Government’s First Homes scheme. This scheme offers new homes discounted by at least 30% compared to market value for first time buyers. The discount is then passed on to future sales. There are conditions around the maximum value of the property (£250,000, or £420,000 in London) and the annual household income of the buyers.

Private shared equity schemes such as Deposit Unlock are widely available and allow both first time buyers and home movers to purchase a new-build home with a 5% deposit. Developers have to sign up to these schemes for purchasers to use them. Other private schemes such a ‘Own New’ will also play a role.

New lenders are also entering the market who allow more flexibility with how a purchaser’s family can help with funding their mortgage.

Speak with our mortgage advisers for more information on new Build buying options.

Forces Help to Buy is a loan available to eligible members of the armed forces. It’s an interest free loan payable over 10 years and can be used as the buyer’s main source of deposit. It could work in conjunction with other schemes, for example Help to Buy Shared Equity, which would mean that the purchaser would only require a 75% mortgage with no source of deposit from themselves.

No, the purchaser will require a minimum of a 5% deposit sourced by them through savings or gifted through a family member or friend.

Often referred to as a JBSP mortgage, a joint borrower, sole proprietor mortgage allows parents, family member or friend to be used on a mortgage application without needing to be named on the property deeds. This can help boost the affordability for a mortgage, but avoids the additional Stamp Duty if they already own their own property.

With a JBSP mortgage, the joint borrowers (typically family) accept joint responsibility for making mortgage payments but have no legal claim to the property.

We have close relationships with the lenders and get directly notified of any key policy and rate changes. We also have regular team meetings involving business development managers to ensure we are always fully up to date.

Our office is open 7 days a week until 5.30pm, but we are also available for appointments outside our normal office hours to give purchasers flexibility. We understand not everyone will be available within office hours.

When your allocated adviser is not available, we have fully qualified advisers operating our mortgage desk 7 days a week until 5.30pm. Our mortgage desk advisers can also progress mortgage applications as required.

For a mortgage to be based on employed/self employed income the maximum age the mortgage can run to is typically 75 years old. But there are options beyond this age that are typically based on pension income or equity release, or later life mortgages which may not require any income assessment. Buy to let mortgages can go past 100 years old, this is because it is based on rental income.

Yes, we are experienced and knowledgeable when it comes to the Shared Ownership scheme. We have worked with many reputable housing associations and are competent at using the Homes England calculator.

Interested in working with us?

We’d love to hear from you, send a message using the form below.